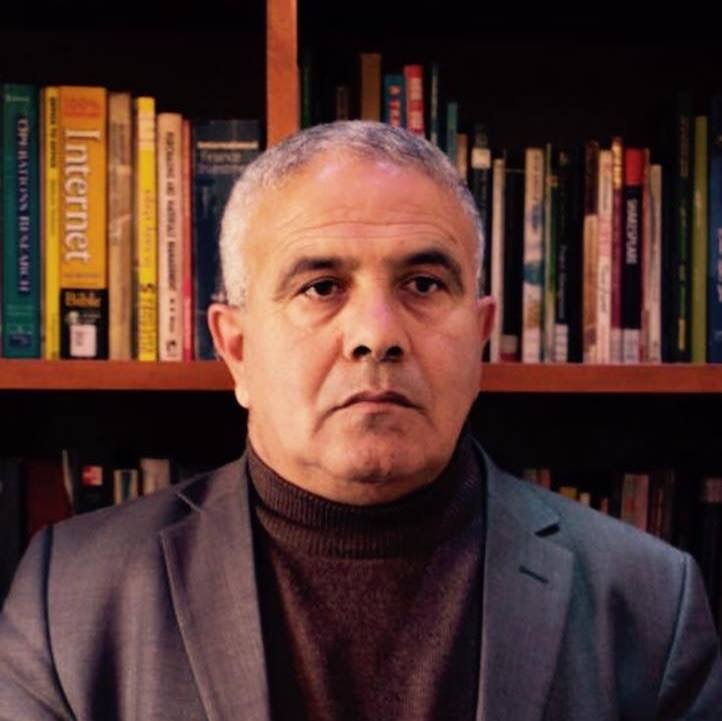

نشر بحث علمي محكم في مجلة دولية من قبل د. عدنان قباجة رئيس قسم العلوم المالية والمصرفية

نشر د. عدنان قباجة رئيس قسم العلوم المالية والمصرفية في كلية العلوم الإدارية والمالية بحثا علميا محكما في مجلة:

Research Journal of Finance and Accounting

Vol.10, No.8, 2019

بعنوان:

Access to Finance for Women-Owned SMEs in Palestine

ملخص البحث:

The aim of this study is to investigate the effects of collateral requirement, Business support services, High interest on loans, and lack of Information services on access to finance by Women-Owned Small and Medium Enterprises in Palestine , A structured questionnaire was administered on a random sample population of Women-Owned SMEs Enterprises in Hebron and Bethlehem , Out of the 60 questionnaires administered, 54 were filled and returned. This represented a response rate of 90%. Data obtained from the questionnaires were analyzed using the Statistical Package for Social Science(SPSS). Questionnaires were administered on the owners of these SMEs and/ or representatives. Multiple linear regression analysis was used to establish the effects of the market constraints on access to finance by Women-Owned SMEs Enterprises in Palestine.

The study indicated that there is a negative correlation between collateral requirements, , High interest on loans, lack of Information services and access to finance by SMEs in Palestine, while there is a positive correlation between Business support services and access to finance SMEs in Palestine. Regression analysis showed that variation in access to finance by SMEs can be explained by collateral requirement, Business support services, High interest on loans, and lack of Information services. The study recommended that, financial institutions should simplify their lending criteria and pay attention to opportunities for financing the promising SME sector rather than requiring high collateral ,Government should increase the little support it offers to SMEs, government should launch interest rate-supported programs to enable SMEs access to funds from banks and other financial institutions at low interest rates, increasing the number of intermediaries between the SMEs and the banks to reduce information asymmetry.

رابط البحث:

https://www.iiste.org/